Private School Finances: An Overview for Business Managers

Managing school finances can be a time-consuming and complex task for business managers. From collecting tuition payments to managing financial aid and tracking outstanding balances, schools need an efficient system that simplifies these processes. Gradelink streamlines school payments and reporting, offering an all-in-one solution combining academic and financial management in a single platform. Parents can view both grades and tuition balances in the same system, making it easier to stay informed and up to date.

Let’s explore how Gradelink’s financial tools can help schools efficiently manage tuition collection, automate financial workflows, and improve reporting.

Easy Tuition Management

Gradelink integrates financial tools with student records, attendance, and communication, eliminating the need for multiple platforms. The financial area is designed to be lean and easy to use, focusing on the essential tasks schools need for billing without unnecessary complexity. This seamless integration saves administrators time and reduces manual work. Schools can:

- Track tuition and fees. Keep a real-time record of outstanding balances and automate invoicing.

- Enable parents to view and pay their bill from their existing Gradelink login, making it convenient to manage tuition alongside their child’s academic progress.

- Automate payment plans. Allow parents to break tuition into smaller installments, reducing the financial burden.

- Access real-time financial reports. Gain insight into school revenue and outstanding payments with built-in reporting tools.

- Process online and in-person payments. Accept various payment methods, including credit cards, ACH, and cash.

Gradelink has positively changed the way we do our attendance tracking, report cards, grading and billing.

—Debra M., Office Manager

Seamless Parent Payment Experience

As a school business manager, you know how important it is to make paying tuition as simple as possible for parents. Gradelink ensures that schools can accept payments in multiple formats, providing families with flexible options to stay on top of tuition and other expenses. When payments are easy to make, schools experience fewer late payments and a smoother financial process.

- Electronic payments: Accept ACH, Visa, MasterCard, Discover, and Amex, giving parents flexibility.

- Cash and check payment: Schools can track and record cash or check transactions for accurate bookkeeping.

- Customizable fee absorption: Schools can either absorb transaction fees or pass them on to parents to help control costs.

Easy AutoPayments

Manually processing tuition payments can be time-consuming and prone to errors. Parents have to remember to write checks, and administrators have to track and deposit them. With Gradelink, schools can set up automated payment plans, eliminating these hassles. Automated payments ensure tuition is collected on time, reducing the risk of late payments and saving both parents and administrators time.

- Custom installment plans: Schools can offer 10-month plans, bi-annual payments, or full upfront tuition payment options.

- Recurring charges and credits: Assign automatic recurring charges or apply financial aid credits to student accounts.

- Auto-posted payments: Ensure payments are posted directly to student accounts, reducing manual entry errors.

- Financial aid and scholarship management: Schools can schedule scholarship disbursements and financial aid credits within the same system.

- Automatic categorization: All online payments are automatically assigned to billing categories such as tuition, registration, and extracurricular fees.

Watch a demo to see how Gradelink can simplify payments and reporting for your school.

Bank Deposits

Gradelink simplifies the process of tracking financial transactions and reconciling accounts. Administrators can:

- Track daily lump sum deposits: Payments appear as combined transactions in the school’s bank account, reducing reconciliation time.

- Automate transaction fee deductions: Fees are deducted once per month as a lump sum labeled Merchant Inc. PaySimple to simplify accounting.

- Assign transactions to specific accounts: Schools using multiple bank accounts can designate transactions accordingly for better organization.

- Detailed transaction reports: Gradelink provides comprehensive transaction reports showing all transactions between two selected dates, such as this week or last week. This feature simplifies bank reconciliation by allowing schools to match transactions in Gradelink with their bank statements easily.

[Gradelink's] financial portion makes it easy to consolidate all the billing in one location and it is easy for our parents to see their statements and make payments.

—Wendy S., Office Manager

Transaction Processing and Fee Handling

- Full payment received upfront: Schools receive the full payment amount from parents at the time of the transaction. For example, if a parent pays $100 with a 3% transaction fee, the school receives the full $103. The back-end reporting creates a separate column for the $100 and $3 transaction fees.

- Monthly fee deduction: Transaction fees are deducted once per month as a lump sum by PaySimple (Merchant Inc. PaySimple). In the example above, a $3 transaction fee would be deducted at the end of the month, ensuring schools receive the full payment amount initially. This simplifies cash flow management by providing the full payment amount immediately.

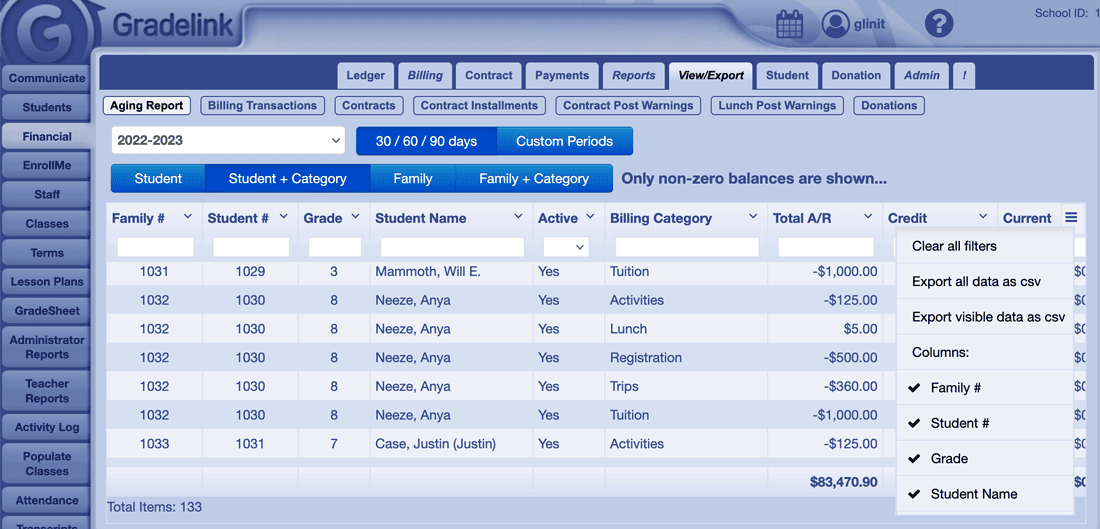

Robust Financial Reporting

Financial transparency is crucial for school administrators and boards. Gradelink offers built-in reporting tools to provide insight into tuition payments, outstanding balances, and financial trends.

- Account Summary Report: View balances categorized by billing type, helping track revenue streams.

- Aging Report: Identify overdue accounts and outstanding balances, allowing schools to follow up effectively.

- Payments Report: Track all electronic payments, transaction fees, and processing dates.

- Auto-Pay Plan Report: Monitor installment payment schedules and ensure tuition collection stays on track.

- Customizable Filters: Generate reports by student status, billing category, or payment method for tailored financial insights.

- Export to CSV or PDF: Easily share financial reports with accounting teams or school leadership.

Security & Compliance

Handling sensitive financial transactions requires a secure system. Gradelink prioritizes security and compliance to protect school and parent financial data.

- PCI compliance: Meets industry standards for secure payment processing.

- Data encryption: Protects sensitive financial information from unauthorized access.

- User access controls: Allows administrators to set permissions for financial data access.

- Audit logs: Keep a record of all transactions, ensuring transparency and accountability.

Why Schools Choose Gradelink for Financial Management

Schools that use Gradelink for financial management experience:

- Reduced administrative workload: Automation eliminates the need for manual data entry and repetitive tasks.

- Improved cash flow: Flexible payment plans and automated invoicing encourage timely tuition payments.

- Enhanced parent satisfaction: A user-friendly interface makes it easy for parents to manage school payments online.

- Increased financial transparency: Detailed reporting tools provide valuable financial insights to school leaders.

Conclusion

Managing school finances doesn’t have to be complicated. Gradelink streamlines school payments and reporting, offering an all-in-one solution for tuition collection, automated invoicing, and real-time financial tracking. With flexible payment processing, automated billing, and powerful reporting tools, Gradelink simplifies financial management for schools of all sizes.

Gradelink Payments

Get Started with Payment Processing

We’ve partnered with PaySimple, an established leader in payment processing. Together we are able to offer Gradelink users exclusive pricing and low credit card rates. With no long-term contracts, no late fees assessed, and an easy setup process for you and your students, your school community could save thousands by switching to Gradelink Payments.

Fill out the form or call us at 800-742-3083 or to learn more.